Login

Or

Log in with Google

Registration

Or

Register with Google

Establish a turnkey company

Individual entrepreneurship in 1-3 days

LLC, JSC - up to 5

Submit an application in a few clicks on the Documan™ platform

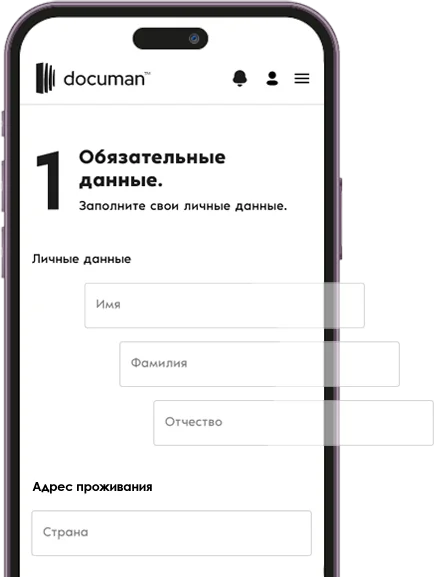

1

Select the business type

Select the appropriate legal form of business

2

Complete the data and gather the documents

Follow a few simple steps: complete the forms and select your preferred tax option. Obtain the required documents with our assistance

3

Sign the documents with the assistance of our staff

Select a convenient time and location to finalize the paperwork. Your signature will be required to activate the application. Alternatively, you can visit our office to sign the power of attorney and other required documents and/or submit your paperwork

4

Documan™ will handle the rest

While Documan™ is actively processing your registration, you can monitor the status of your business registration and ask any questions through our simple and user-friendly interface

Individual Entrepreneurship, LLC, or JSC?

Individual Entrepreneur

Looking to manage your business, control your risks, and maintain relatively simple records? Start with individual entrepreneurship

Registering an individual entrepreneurship typically takes 1 to 3 working daysIE

Limited Liability Company

If you intend to register a legal entity either individually or with up to 50 co-founders, conduct banking operations, and limit liability, an LLC is the most suitable choice for you

The registration of an LLC typically takes 3 to 5 working days, and the LLC is required to have a registered directorLLC

Joint-stock company

A joint-stock company is a suitable choice for attracting investments and selling shares. You have the option to register either an open joint-stock company (JSC) or a closed joint-stock company (CJSC, with a maximum of 50 shareholders). Participants in a JSC are liable for risks only up to the value of their shares. It is also possible to register a joint-stock company with just one shareholder

The registration of a JSC typically takes 3 to 5 working days. A key distinction between an LLC and a JSC is that, after the company's registration, the shares of the JSC must be recorded. Shareholders' information is entered into the register through one of the operators of the Central Depository, and each shareholder must have a personal account for the accrual of the company's shares

Documan™ will handle all payments and procedures

Simplicity and efficiency

Follow the simple instructions. We've streamlined the process to make it as user-friendly as possible, and our team, including our chat support, is available during all business hours to assist you

Corresponding Address

You will require a correspondent address for official notifications. If you do not have one, we can provide you with an address for a fixed yerly fee.

Public service number

When starting a business, obtaining a public service number is necessary for registration in the tax system

All payments in one place

All necessary payments, including state fees, are consolidated into a single payment. Receipts for all state payments are accessible in your account

Tax support

After registration, please inform us of your intention to activate tax, accounting, and/or legal support services. Together, we will select an appropriate monthly plan, streamlining bureaucratic processes and resolving essential accounting and legal matters

Financial Services

After registering your business, we can assist you in opening a bank account, obtaining a bank card, and acting as your representative at any financial institution

Experience in Armenian legislation

Over 200 businesses have started and relocated with help of Documan™, facilitating more than 500 deals

Get a residence permit in Armenia based on having a registered business

How to get a residence permitFAQ

What types of taxation exist in Armenia?

1. VAT (value added tax) in Armenia is levied on supplied goods and services. The VAT rate may vary depending on the type of goods or services, in most cases 20% of the price of goods or services.

2. Income tax is imposed on legal entities and individual entrepreneurs. The tax base is the company's net profit for the tax year. The profit tax rate is 18%.

3. Turnover tax is a special tax regime replacing value added tax (VAT) and (or) profit tax (corporate tax) with a tax rate of 5% from total turnover. It can be applied by individual entrepreneurs (IE) and legal entities

4. Personal Income Tax (PIT) is a tax levied by the state on income earned by individuals. Income subject to tax may include wages, interest from bank deposits, rental income from real estate, capital investments, shares and other sources of income. The personal income tax rate may vary depending on the type of income.

5. Social contributions are withheld from employees' salaries and allocated to social security, including pension benefits and medical care.

6. Excise tax is levied on several specific goods such as alcohol, tobacco, gasoline and some other goods. Excise tax rates may also differ from each other.

7. Property tax in Armenia is levied by property owners and is based on the value of the property. The amount of tax may vary depending on the location and value of the property.

8. Customs duties are levied when goods are imported across the customs border of Armenia.

Each type of tax may have its peculiarities, rates and payment rules, so it is important to understand them in detail according to specific circumstances. However, with the Documan platform, there is no need to understand the intricacies of Armenian legislation: we will explain and help you quickly go through all the steps to choose the right type of taxation

Is it possible to register a company without an address in Armenia?

A legal address is mandatory for doing any kind of business in Armenia. In case of absence, Documan can provide a correspondent address for your business in Armenia for a fixed yerly fee

What are the advantages in Armenia for doing business?

Armenia offers several advantages for businesses, including:

1. Convenient geographical location: Armenia is at the crossroads of Europe and Asia, making it an ideal point to access a variety of markets.

2․ Access to EAEU markets: Armenia is a member of the Eurasian Economic Union (EAEU), which provides access to a large domestic market including Russia, Kazakhstan, Belarus and Kyrgyzstan.

3. Investment incentives: The government provides various tax breaks and investment incentives to attract foreign investors.

4. Skilled labor force: Armenia has an educated and technically competent labor force, which makes it attractive to companies requiring specialists in various fields.

5. Emerging IT sector: Armenia is becoming a center for IT and startups, providing tax benefits and many opportunities for innovation.

6. Low operating costs: Comparatively low costs for office rent, labor and energy make Armenia competitive

7. Quick registration procedures: The company registration process is relatively simple and quick.

8. Favorable investment environment: Armenia provides a stable political and economic environment, which is important for long-term investments.

What is included in Documan's legal support?

We provide regular consultations, document preparation, registration and licensing, and assistance with tax and other legal matters. Our team of lawyers will make sure that you are aware of all legal requirements and can focus on your activities with peace of mind

What is included in Documan's accounting tax support?

Our primary goal is to enhance your tax efficiency. We offer expert tax advice, conduct a thorough analysis of your corporate situation, and assist you in optimizing your tax responsibilities. Our services encompass various aspects, including bookkeeping (comprising income and expense accounting), the preparation of financial statements, and the filing of tax returns. Our seasoned accountants ensure that you adhere to all accounting standards and requirements, maintaining accurate and up-to-date financial data.

Additionally, as part of our accounting support, we handle the preparation and submission of all necessary documents and declarations to tax authorities, thereby ensuring compliance and minimizing risks

Who can register an Individual Entrepreneurship (IE)?

An individual entrepreneur in the Republic of Armenia may be any legally capable person (citizen of the Republic of Armenia, foreign citizen or stateless person) whose right to engage in entrepreneurial activity is not restricted by law. In particular, a person cannot be registered as a sole proprietor if they have been deprived of the right to engage in entrepreneurial activity by a court of law. The criminal record has not been removed or extinguished by the established procedure, or the person has been recognised bankrupt by a court of law and, when applying for state registration, has not fulfilled his/her obligations that served as a basis for such recognition. IEs may have their employees

What are the requirements for registering an Individual Entrepreneurship?

To register an IE on the territory of the Republic of Armenia, you will need:

1. Valid passport (Translation if necessary)

2. Armenian phone number

3. Legal address on the territory of Armenia

4. E-mail

5. Choice of type of activity

6. Choice of the type of taxation

What is the advantage of registering an Individual Entrepreneurship for foreign citizens in the Republic of Armenia?

Registering a individual entrepreneurship in the RA offers several advantages, including:

1. Cost-effective setup.

2. Ability to open bank accounts for individual entrepreneurs (IEs) and non-resident individuals.

3. Opportunity to obtain a residence permit in the Republic of Armenia.

4. Capability to receive and send payments from anywhere in the world.

5. Potential to conduct business with counterparties from any country

Is it possible to close an Individual Entrepreneurship afterwards?

Yes, it doesn't take long to close an individual entrepreneurship. But before closing an individual entrepreneurship, you need to ensure you don't have any tax liabilities

Are there any consequences after registering an Individual Entrepreneurship?

After establishing a individual entrepreneurship in accordance with Armenian legislation, you are obligated to pay mandatory fixed taxes known as 'income tax' and 'compulsory social payments,' each amounts to AMD 5,000 per month. In addition, there is a variable tax called the 'trade turnover tax,' the amount of which depends on the revenue generated by the individual entrepreneurship

Who can incorporate a Limited Liability Company (LLC)?

A limited liability company in the Republic of Armenia may be registered by any legally capable person (a citizen of the Republic of Armenia, a foreign citizen or a stateless person)

How long will it take, and how much does it cost to register an LLC?

State Registration of a Commercial Enterprise in Armenia takes different time depending on circumstances:

If the founder is an individual, registration takes one working day.

If the founder is a legal entity, it takes two working days.

Preparation of necessary documents varies based on the founder's status.**:Non-Resident Founder: If the founder is a non-resident commercial company, the process typically takes five to eight working days.This includes opening a bank account and obtaining a company seal.

Additional Costs:Legal and accounting costs are calculated separately based on the service provider.

Documan offers a comprehensive package, including bank account opening, but excludes third-party fees (e.g., banking, translation, notary, courier) which are charged separately based on actual invoices from third parties

Can an LLC be closed down afterwards?

open-business-question-description-13

Start registering an individual entrepreneurship or legal entity in Armenia